Seek Inspiration for your Greenhouse

Our aim is to inspire you with the many joys, possibilities, and purposes that greenhouses can offer you. We Help People Grow.

Ten top tips to frost proof your greenhouse this winter

As winter approaches, ensuring your greenhouse is frost-proof is essential for protecting your plants and maximising your gardening efforts...

Greenhouse Types and Uses – A Decision To Be Made?

Your new greenhouse can become your garden sanctuary, and there's more to a greenhouse than just a tool for growing plants...

Grow your own micro greens for Christmas

Micro herbs are August Bernstein’s antidote for winter’s lull as they keep the joy of growing alive and adds a fresh punch to Christmas canapés...

5 Greenhouse Plants To Get You Started

Experience the thrill of exploring the world of greenhouses and their potential for cultivating a wide array of plants. From juicy tomatoes to refreshing citrus fruits, receive guidance to kickstart your greenhouse gardening journey successfully...

Children, the next Budding Gardeners

For Mark Spencer, spending time in the garden with his daughter is a shining highlight. In this text, he shares his experiences and insights on how gardening not only promotes physical and mental health but also strengthens family bonds. Spencer explores how quality time in the garden has led to a rediscovery of the joy of cultivating plants with children, and hopes that this experience will inspire future budding gardeners...

What is a Cold Frame?

If you ask gardening expert Eliot Coleman about cold frames, he will tell you are they the most dependable, least exploited piece of gardening kit you can buy...

The Advantages Of A Grow & Store Greenhouse

If you're considering a greenhouse or a shed, why not combine the two and invest in a Grow & Store greenhouse? This versatile garden building offers you the benefits of both a greenhouse and a storage shed under one roof...

Why Choose A Single Brick Wall Type For Your Greenhouse

When modern aluminum frames dominate, brick walls offer not only aesthetic appeal but also long-lasting functionality. Their stability allows for higher roofs, maximizing space and accommodating tall plants. At the same time, they provide shade and heat accumulation, extending the growing season and ensuring the well-being of the plants...

Diary of an Expectant Greenhouse Gardener: Part 1

This blog is for me to share my journey as the dream slowly turns into a reality. Here I want to invite you to join me in this greenhouse gardening adventure from knocking down the old chicken coop to my first tomato or even the gin & tonic with my own lemon...

Diary of an Expectant Greenhouse Gardener: Part 2

The greenhouse is on its way and now it’s time for the hard work to begin, in clearing and preparing the ground where it will finally stand...

Diary of an Expectant Greenhouse Gardener: Part 3

The ground has been cleared and the brambles are all gone. At this point the chickens are homeless and are having a great time wreaking havoc in my borders and terrorizing the dogs, even our two cats are scared of them...

Diary of an Expectant Greenhouse Gardener: Part 4

We are ready to start at last and we have been debating whether to build a dwarf wall as a base for the green house...

Gabriel Ash and Juliana on Social Media

Greenhouse life is the sum of seeing its efforts grow, germinate and spread. Outside the greenhouse, it happens to a large extent on social media...

Share your greenhouse joys

with many other greenhouse enthusiasts

Follow us here

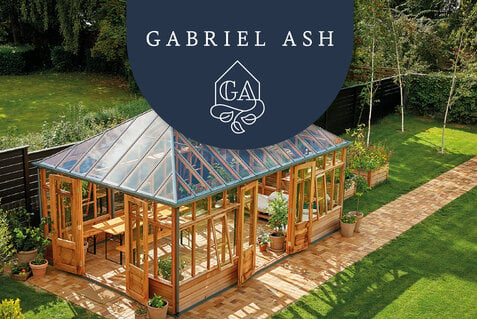

Need more inspiration?

Whether you need a greenhouse, wall greenhouse, or orangery, Gabriel Ash undoubtedly has what you're looking for. - Request a brochure and let yourself be inspired.

Juliana Group

Juliana Group is a leading global supplier of quality residential greenhouses. Founded in 1963 by Mogens A. Stærmose in Odense, Denmark, the family-owned company is today run by third generation, Nikolaj Stærmose. Headquarter and production remains Odense-based with subsidiaries in the UK and Germany and export to more than 20 countries.

’We help people grow’. That is why our brands Halls, Juliana, and Gabriel Ash all set the frame for experiences that are as natural as they are magical. Despite our long history, we’re future-focused and curious on how we can improve the sustainability of our greenhouses. Learn more about Juliana and find inspiration for life in the greenhouse in our inspirational universe.